Reconciling a VAT Period with the VAT 126 Report

The VAT 126 report can be used if your organisation is not VAT registered. This report can be used as evidence to support your VAT claim. To reconcile the VAT 126 report with the VAT Account:

- In IRIS Financials go to Modules > Reporting Suite and click on the VAT 126 report in the Additional Reports section.

-

Use the drop-down lists at the top of the report to select the VAT Ledger Code, VAT Period and VAT Input Nominal(s).

If you are only doing the VAT return for one location, just select their applicable VAT nominal(s).

-

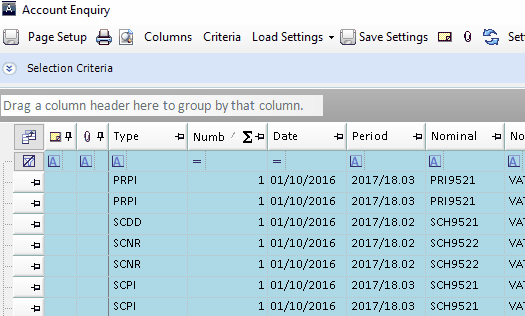

On the VAT account Account Enquiry in IRIS Financials, drag the Document Type column to the Drag a column header here to group by that column section.

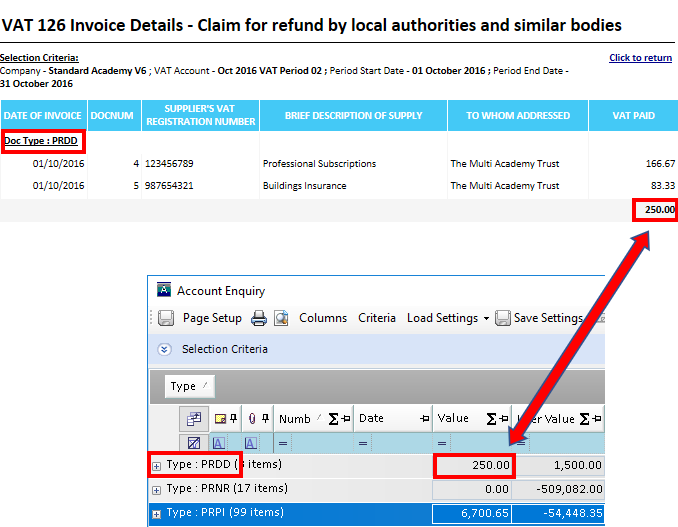

This will summarise the VAT account by document type. You can now reconcile the Value field on the VAT Account Enquiry with the VAT Paid column on the VAT 126 Report. - Compare the total for each document type on both the VAT 126 report and the Account Enquiry. The following graphic shows the PRDD document type as an example.

- Repeat for all document types.

Discrepancies

Various discrepancies may be identified when preparing for or running the VAT return. See Dealing with VAT Discrepancies.

Next Steps:

Once the report has been reconciled with the VAT period, you are then ready to process the VAT return as described in Processing a VAT Return