Reconciling a VAT Period with a Trial Balance

When a document is posted in IRIS Financials transactions are posted to an accounting period and a VAT period, both of which are independent of each other. This means that transactions can be posted to differing accounting and VAT periods. This typically occurs if an invoice has been received late and the VAT return for that period has already been completed.

For clarification:

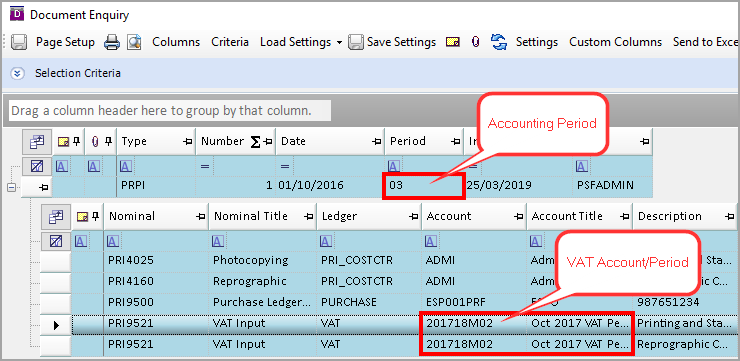

Accounting period - The period in which the entire transaction is recorded, e.g. 2017/18.03. This is displayed on the header line of the document

VAT Account - Each VAT period exists as an account on the VAT ledger, e.g. 201718M02 and denotes which VAT claim period the document falls into. This is displayed on the VAT line of the document.

When reconciling the VAT account details back to the trial balance it is important to recognise that these are separate, as it is possible to post a document into one accounting period but a different VAT period.

To check which Accounting periods are appearing in a VAT period/account:

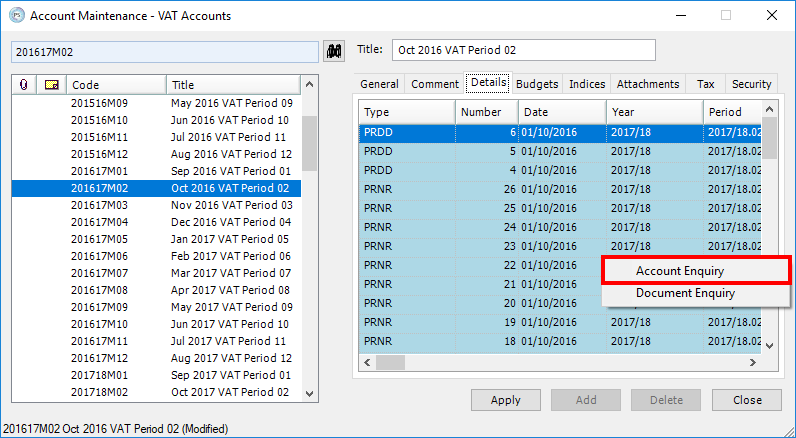

- In IRIS Financials, select Masters > Accounts.

- The List of Ledgers window is displayed. Double-click on VAT Accounts.

- The list of VAT accounts is displayed. Click the Details tab and right-click anywhere on the preview window. Select Account Enquiry.

- Click on Criteria at the top of the Account Enquiry window. When the Selection Criteria window displays, click the Criteria tab and ensure the Periods drop-down list is set to All. Click the OK button.

- On the VAT Account Enquiry window, drag the Period column to the Drag a column header here to group by that column section.

This will show you the balances by accounting period for the specified VAT account.

Why does this happen?

If an invoice is received late for example, and the previous VAT period has already been closed, the system will allow the document to be posted to the correct accounting period, but will automatically post the VAT element into the next available VAT period to be included in the next claim.

When running the Trial Balance on the other hand, the criteria only allows you to specify the Accounting period, regardless of VAT period.

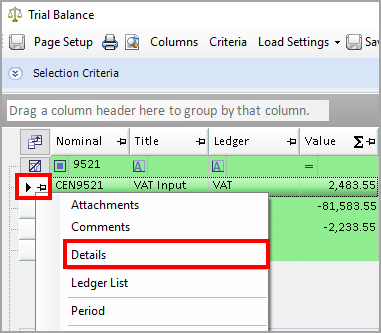

- Go to Options > Trial Balance and enter the applicable details in the Selection Criteria window.

- Find the applicable VAT nominal and right-click in the grey box and select Details.

- On the Account Enquiry window, drag the Account column to the Drag a column header here to group by that column section.

This will show you what VAT accounts the documents in your trial balance are posted to.