Submitting a VAT Return using Making Take Digital

To submit the electronic return, open the MTD Making Tax Digital module from the IRIS Financials folder found in the Start menu.

If you are not on PS Cloud, in order to submit the electronic return, you need to open the MTD Making Tax Digital module. Typically, this can be found by selecting Start > All Programs > PS Financials > MTD Making Tax Digital. Speak to your IT department if it has not been installed to this location.

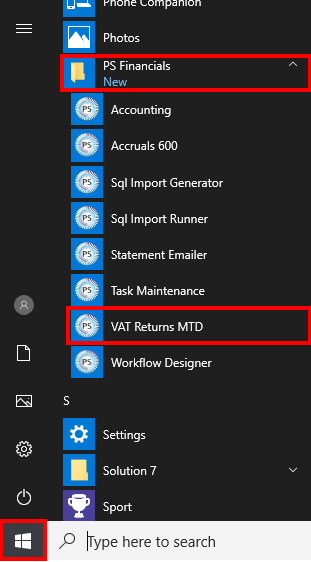

For PS Cloud customers on 2016 servers:

- Click the WindowsStart button in the bottom left of the screen then select PS Financials > MTD Making Tax Digital:

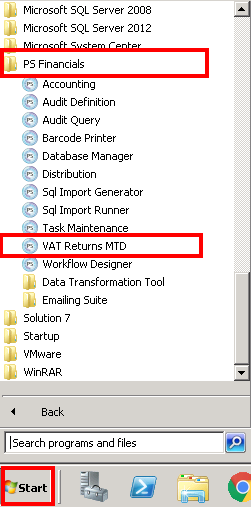

For PS Cloud customers on pre-2016 servers:

Start > All Programs > PS Financials folder > MTD Making Tax Digital:

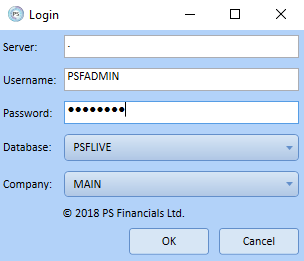

- The login screen appears. Enter your Username and Password and select the applicable Database and Company. Select OK to login.

-

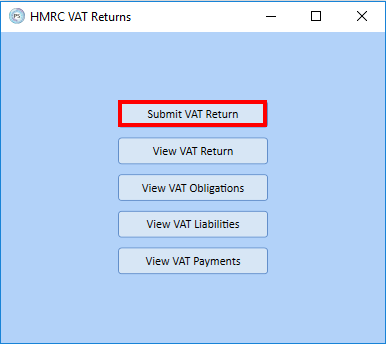

Click the Submit VAT Return.

If this is your first digital submission, none of the other 4 options on this initial screen displays any information.

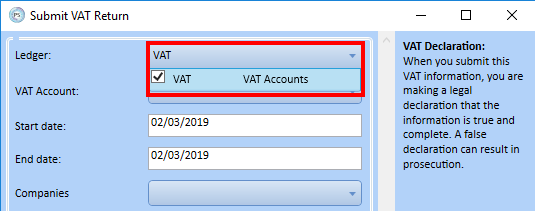

- The Submit VAT Returns window appears. Select the applicable Ledger.

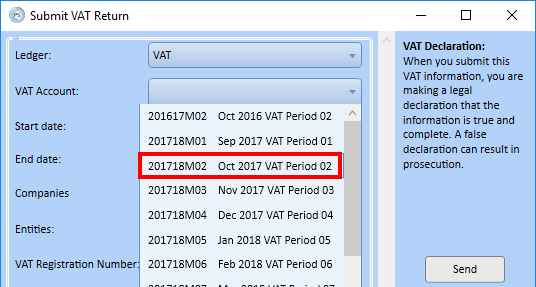

- Select the applicable VAT account. This should be the VAT period or quarter for the submission:

- The Start Date and End Date automatically populates. These are based on the information in the Tax tab of the selected VAT account.

- Select the required Companies.

- Select the relevant locations from Entities. You can submit one location at a time, or multiple locations at once, providing they have the same VAT registration number.

- The VAT Registration number automatically populates. This is generated from the ACADEMY ledger for the selected location(s).

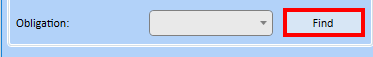

- Select your obligation from the Obligation drop-down list. The Obligation field relates to the Last date to submit the Tax return for the VAT period.

If the Obligation box is greyed out, click Find to re-direct to the HMRC website to register your Making Tax Digital account.

- The VAT return boxes will contain the data for the VAT submission. This data should match that of the applicable VAT account and VAT 100 report which have been reconciled in the previous section within this article.

Nominal VAT 100 Box Value User Value 9521 - VAT Input Box 4 Box 7 9522 - VAT Output Box 1 Box 6 9526 - Reverse Charge EU Output Box 2 9527 - Reverse Charge EU Input Box 4 Box 7; Box 9 9528 - Net Sales - EU Supplies Box 1 Box 6; Box 8 -

Select Send to submit the VAT return to HMRC.

It is your own responsibility to ensure the information submitted to HMRC is correct. Please ensure the VAT return is correct before submitting to HMRC.

- After the VAT Return is submitted, the VAT transfer document in IRIS Financials will need to be posted and the VAT account/quarter will need to be allocated and closed as per the academy/MAT's usual procedures. Further information on this can be found on our Consolidate VAT Return .