Overview of Fixed Assets and Depreciation

What is a Fixed Asset?

A fixed asset is a long-term tangible piece of property or equipment that an establishment/organisation owns and uses in its operations. They are not expected to be consumed or converted into cash within a year and commonly appear on the balance sheet as property, plant, or equipment. They are also referred to as capital assets.

What is Capitalisation?

The decision and process of recording a purchase as an asset rather than an expense is referred to as capitalisation. An item is considered an asset rather than an expense if it has a useful life longer than one financial year, and costs more than a pre-agreed capitalisation limit, often £1000. Typical asset examples include computers, printers, office furniture, telephones, software, buildings, vehicles, etc.

Assets are treated differently to expenses in your accounts. Expenses are recorded in the income and expenditure account, whereas assets are capitalised and included in the balance sheet instead.

For accounting purposes, assets are grouped into categories, which can typically include:

-

Land and Buildings

-

Computer Equipment and Software

-

Equipment and Fixtures

-

Plant and Machinery

-

Vehicles

In IRIS Financials,

Fixed assets nominal codes are linked to the Fixed Asset ledger. Within this ledger, accounts can be created to enable individual assets or asset types to be tracked.

What is Depreciation?

Most fixed assets gradually lose their value over time because they have a limited useful life – this is referred to as depreciation. Fixed assets depreciate at different rates, which is one of the main reasons for grouping similar assets into asset types. Assets must be depreciated in the year end accounts to show that they have lost their value.

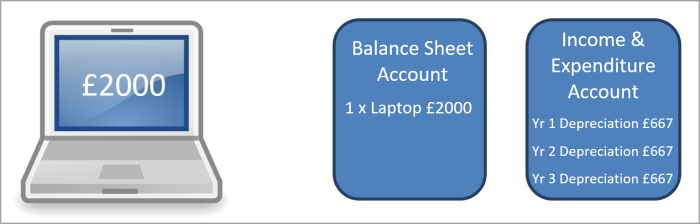

Depreciation is therefore the gradual transfer of the original cost of a fixed asset from the applicable balance sheet account to the depreciation (income and expenditure) account. For example:

A computer is purchased at a cost of £2000 (excluding VAT). The computer is expected to have a useful life of three years.

The balance sheet account will include the asset at its cost of £2000.

In the income and expenditure account, the depreciation is calculated at one third of the original cost (£667). This figure is then included in the establishment/organisation expenses for each of the three years.

There are two methods used to calculate depreciation:

-

Straight Line (SL) – deducts the same amount of depreciation each month/year until the asset is written off.

-

Reducing Balance (RB) – deducts depreciation based on a monthly/yearly percentage, which reduces as each month goes by.

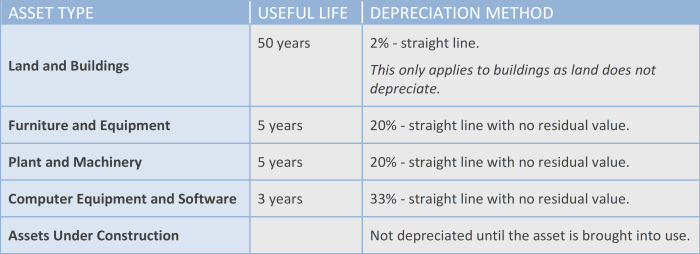

Depreciation rules are usually approved by your establishment/organisation in agreement with financial advisors at the beginning of the financial year and may be similar to the following:

The residual value is the estimated value of a fixed asset at the end of its useful life.