View VAT return summary or details

The images and steps in this topic are based on our new design (which you can currently switch on and off). If you haven't switched the new design on, the images may look different.

As soon as a VAT return obligation from HMRC has been identified, a return record is created ready for you to view and check before submitting to HMRC.

-

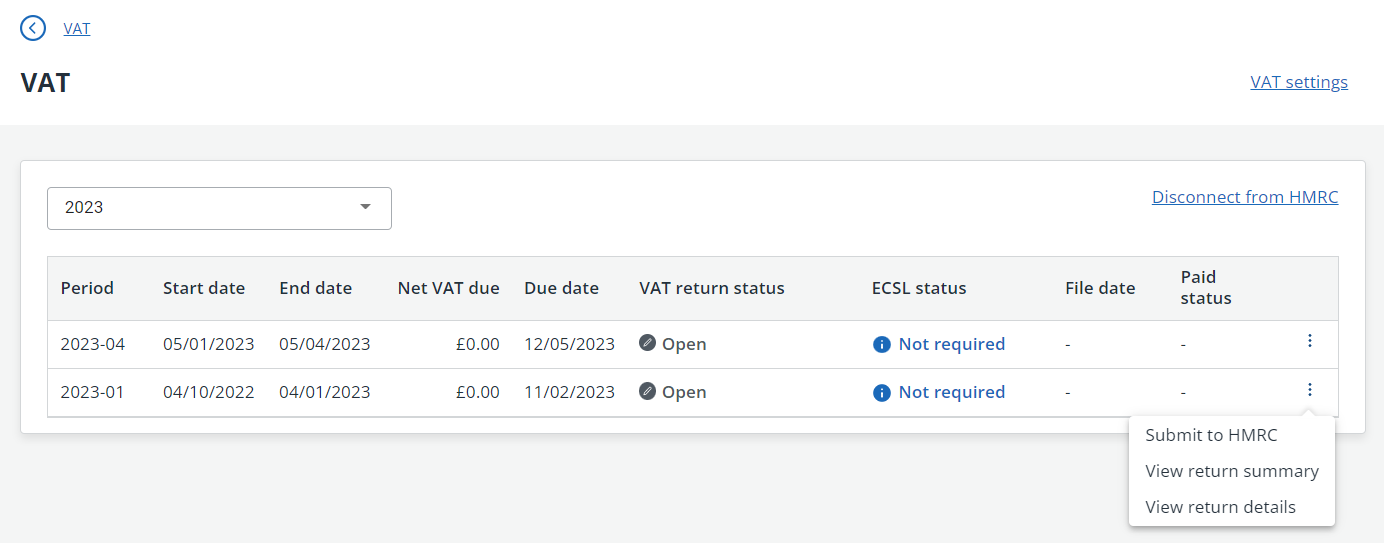

Go to Taxes, then select VAT.

-

Use the More icon on the far right to choose to View Return Summary or View Return Details.

If you are using the current design, select the options from the Action list.

View return summary

The return summary shows a summary list of the VAT for each section of the return. Check that this data is as you would expect.

You can customise the layout, export to CSV or PDF, email or print the summary.

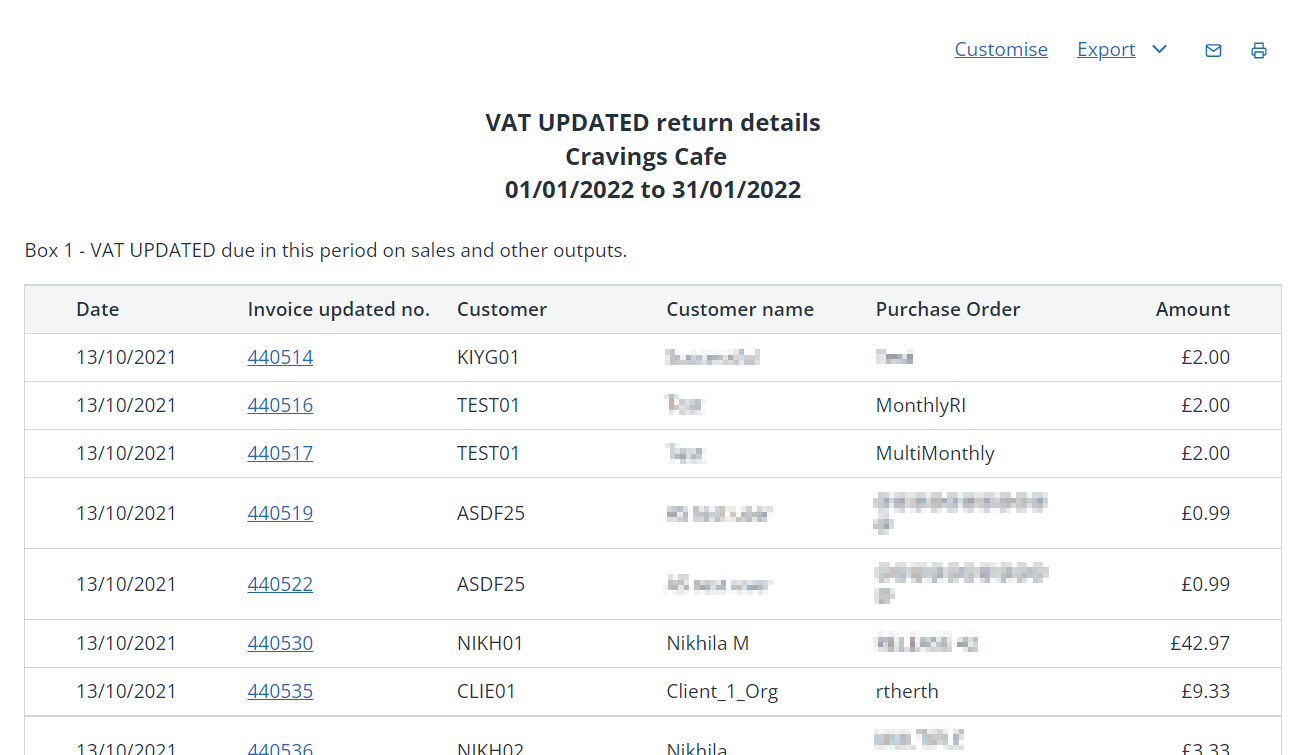

View return details

The return details includes a list of each VAT related transaction separated into each of the return boxes. Check that this data is as you would expect.

You can customise the layout, export to CSV or PDF, email or print the details.

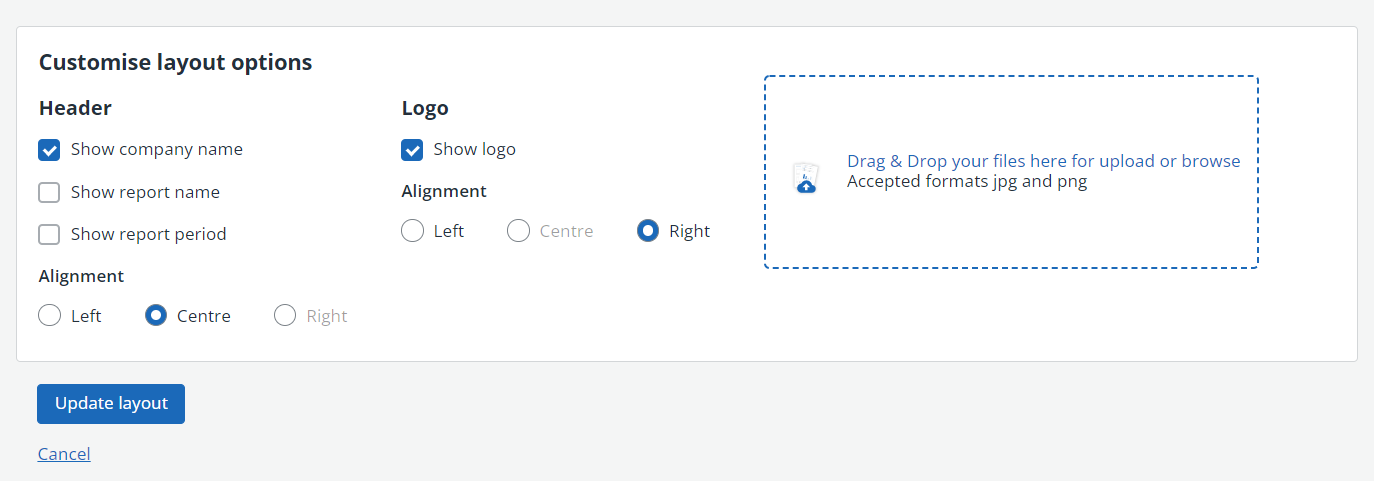

Customise the layout

Use the checkboxes to choose what should be displayed in the header, then select the alignment of the information. You can also add a logo (by dragging and dropping onto the area shown) then choose the alignment for the logo.

Select Update layout once you have made your choices.

Export the summary / detail to CSV or PDF

From the top of the report, select Export then choose Export to CSV or Export to PDF. The export is automatically generated. CSV exports are available for selection at the bottom of your browser (depending on your browser). PDF exports are opened in a separate tab from where they can be saved or printed as required.

Email or print the summary /detail

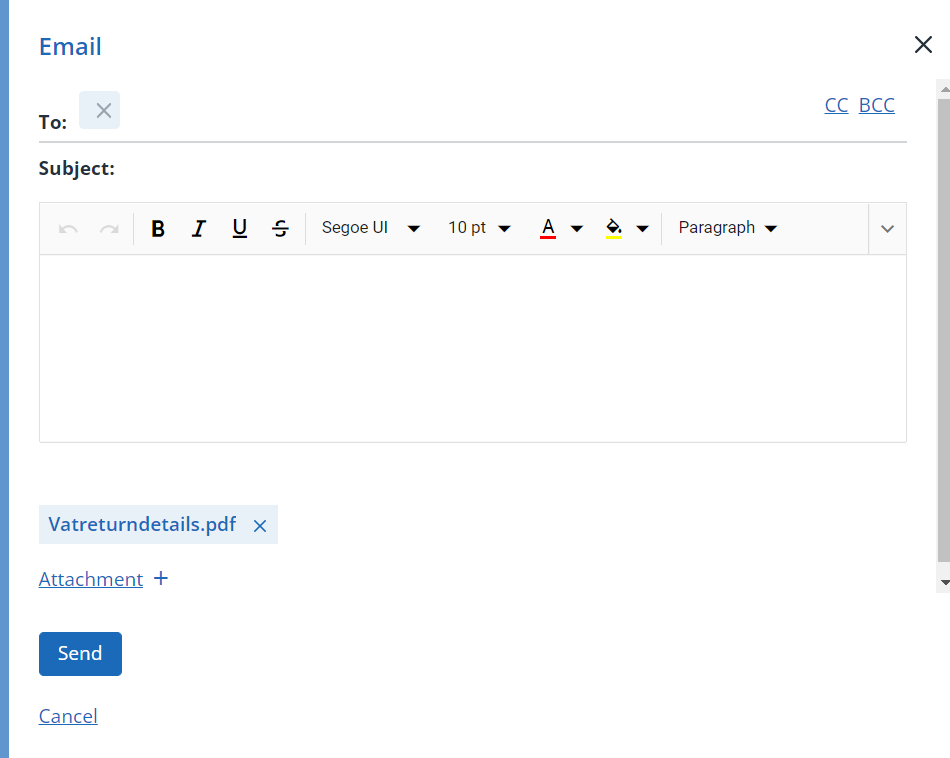

You can easily send an email from within IRIS KashFlow by selecting the email icon at the top of the report. The report is automatically attached to the email. Add the email address and text, then select Send.