Run and submit a VAT return

The images and steps in this topic are based on our new design (which you can currently switch on and off). If you haven't switched the new design on, the images may look different.

You can submit your VAT return direct to HMRC from IRIS KashFlow using the Making Tax Digital (MTD) service.

You must have:

Connect IRIS KashFlow to your HMRC account

Once connected to HMRC, we will automatically retrieve your VAT return due dates (obligations) from HMRC. If there are no returns displayed, there is nothing to do at this point.

Once a return is available:

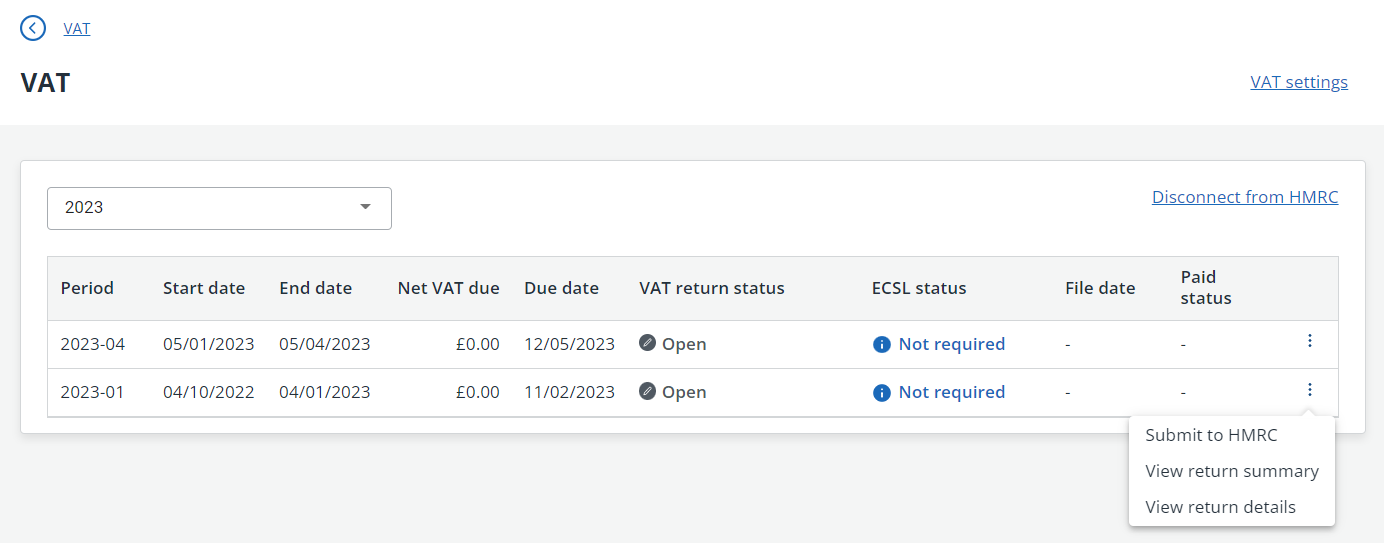

- Go to Taxes and select VAT.

-

Use the More icon on the far right to choose to View Return Summary or View Return Details. At a later date, you can use this option to mark the return as paid. Find out more about viewing the return summary or details.

-

Once you've checked the data and are happy to proceed, from the More icon on the right of the return, select Submit to HMRC.

You cannot submit the return until the period has ended.

-

The return is the marked as Submitted to HMRC and the registered contact email will receive notification that the submission has been sent.