Edit CIS and withholding tax settings

If you work under the Construction Industry Scheme (CIS) or if WHT is applicable in your country (or the country some of your customers are in), then you will sometimes receive less than the full amount of your invoice as the customer has to withhold a percentage of the invoice amount to pay direct to the tax authorities.

-

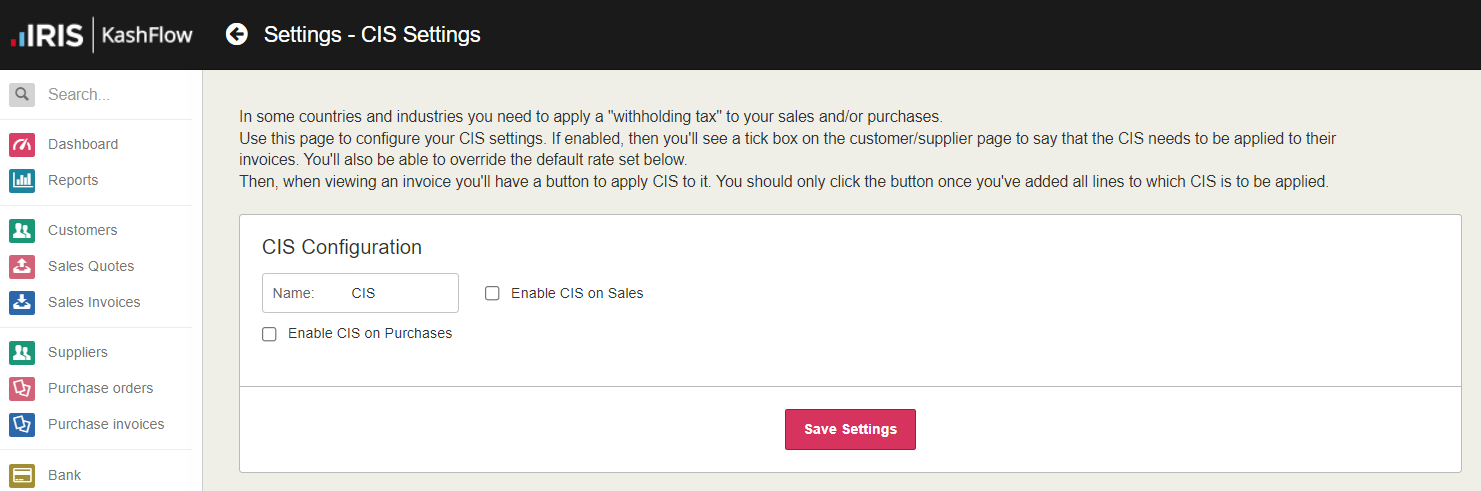

Go to Settings. (If you've switched to the new design, select your initials, then Account Settings.)

-

From Configuration Settings, select CIS Options.

-

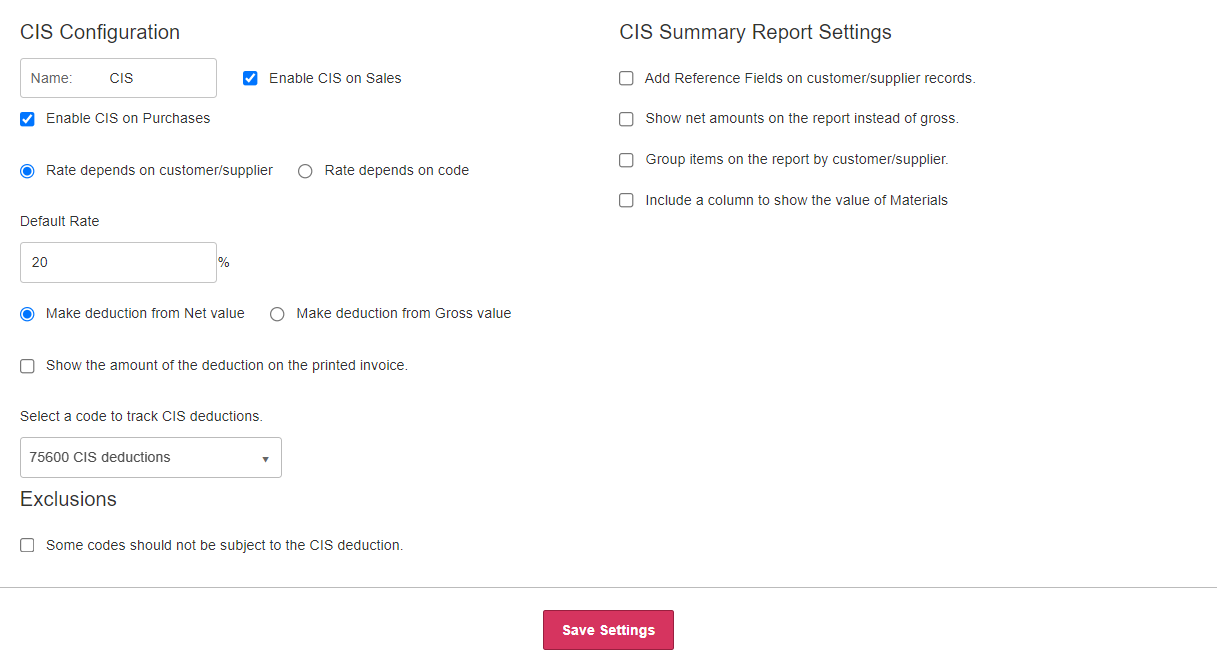

Select the checkboxes to Enable CIS on sales and enable CIS on purchases. Once selected, more options are shown.

-

If your tax is called something other than CIS, then replace CIS in the Name box.

-

Set the Default Rate for the VAT / tax. Under the UK Construction Industry Scheme this is usually 20%. You can adjust this rate on a per customer / supplier basis.

-

Choose whether the Rate depends on customer/supplier or Rate depends on code.

-

Choose whether to make the deduction from the net or gross value and whether to show the amount of deduction on the printed invoice.

- Select the nominal code to use to record the tax deductions. If you’re not sure what to select, check with your accountant.

-

You can set up exclusions to ensure that CIS is not applied to certain sales types.

-

Select Some codes should not be subject to the CIS deduction.

-

Enter a Name for how you want to refer to the excluded items.

-

Select the code from the Add a Code list then select the + icon. Repeat for all the codes to be excluded. An invoice lines assigned to these codes will be ignored.

-

-

Select Save Settings.